Borrowers expect an engaging online experience. Are you delivering?

With Encompass Consumer Connect® borrowers can easily complete an online mortgage application, instantly engage with their loan officer, and securely upload and eSign documents, making it faster and less expensive for a lender to process a loan.

GET STARTED Read datasheetEncompass Consumer Connect features

Encompass Consumer Connect provides a state-of-the-art digital mortgage experience for the home buying process where you can close loans faster, improve the borrower, and ensure compliance. With Consumer Connect, you can create a custom web experience unique to your company, virtually guide borrowers through the loan application process on any device, and provide real-time status updates.

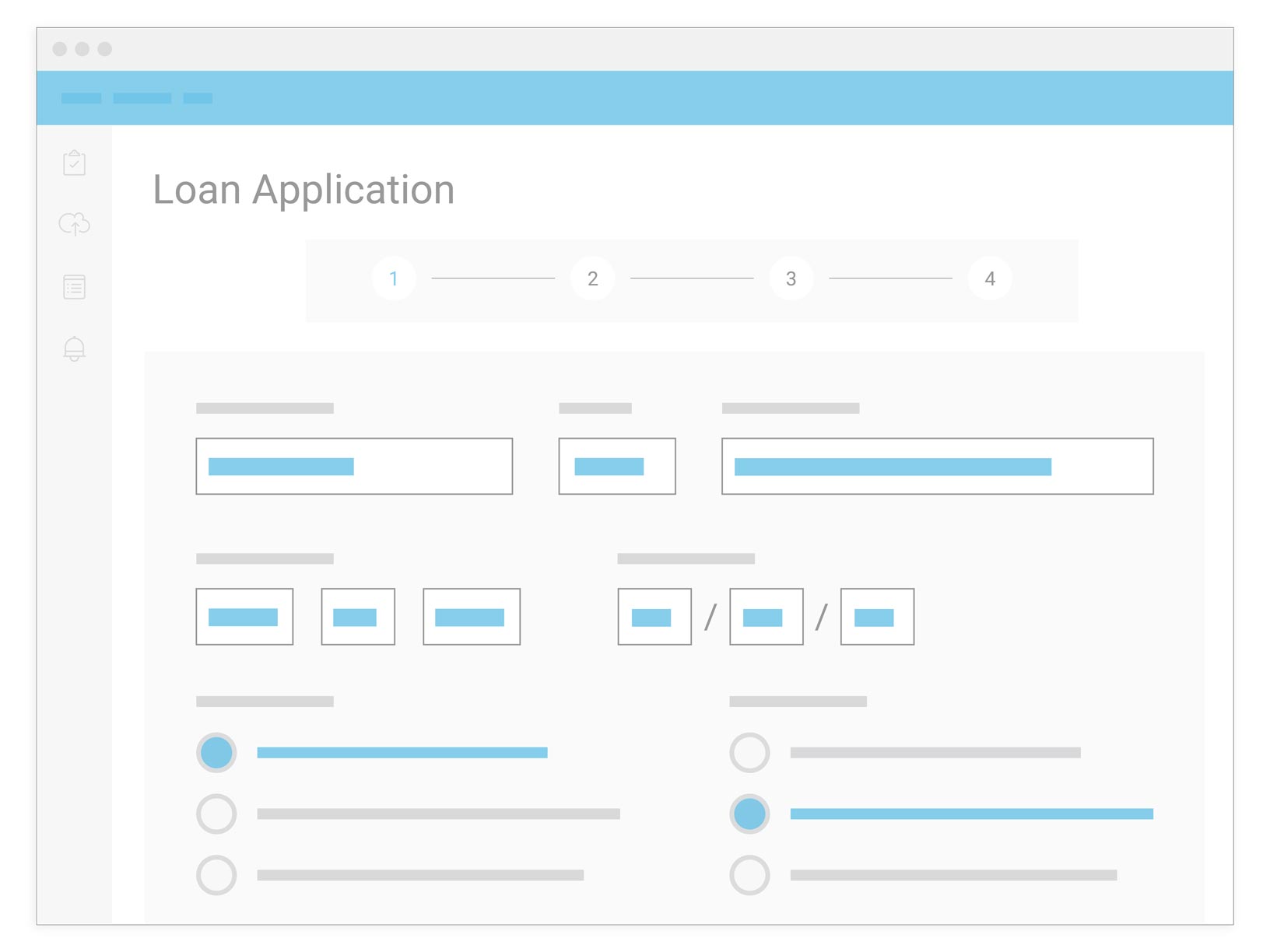

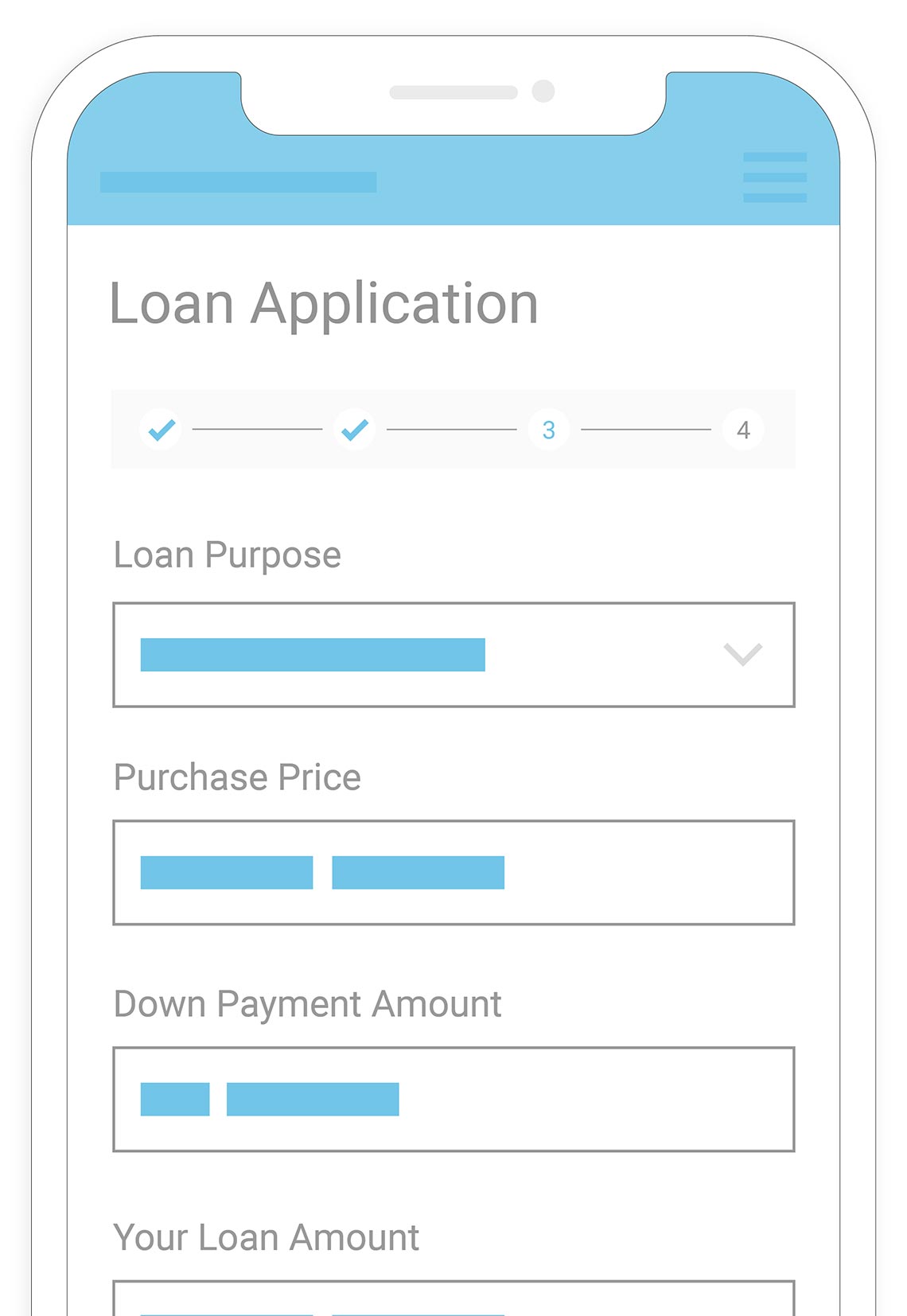

Easy-to-use online application for borrowers

Easily complete mortgage applications online and from any device

Invite/remind the borrower to apply

Capture abandoned applications and increase conversions by inviting and reminding the borrower to complete an application that they have already started in Consumer Connect.

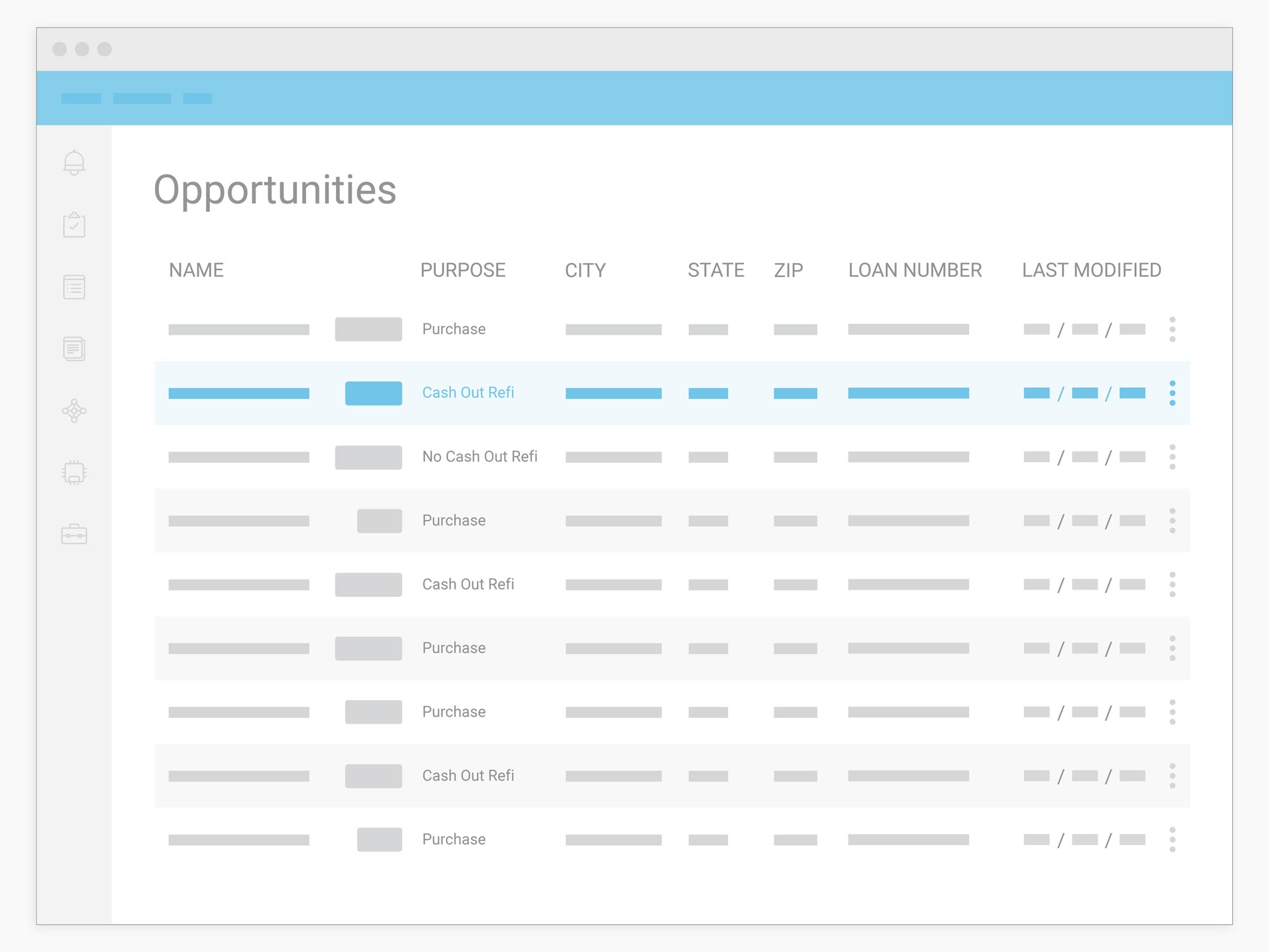

Direct integration with Encompass

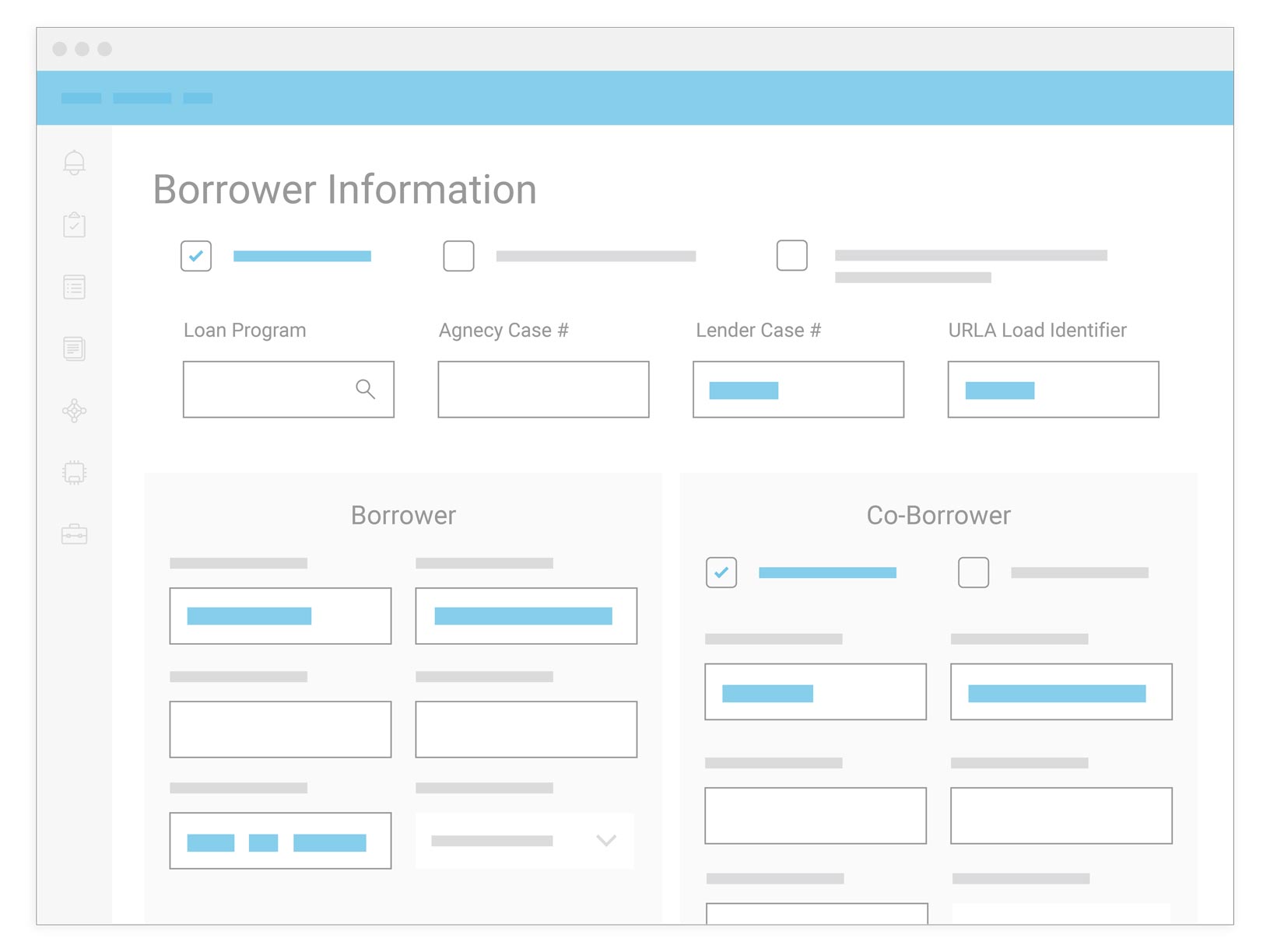

Leverage a borrower point-of-sale solution that seamlessly integrates with Encompass and streamlines everything from online applications to data collection

Integrated services to improve workflow

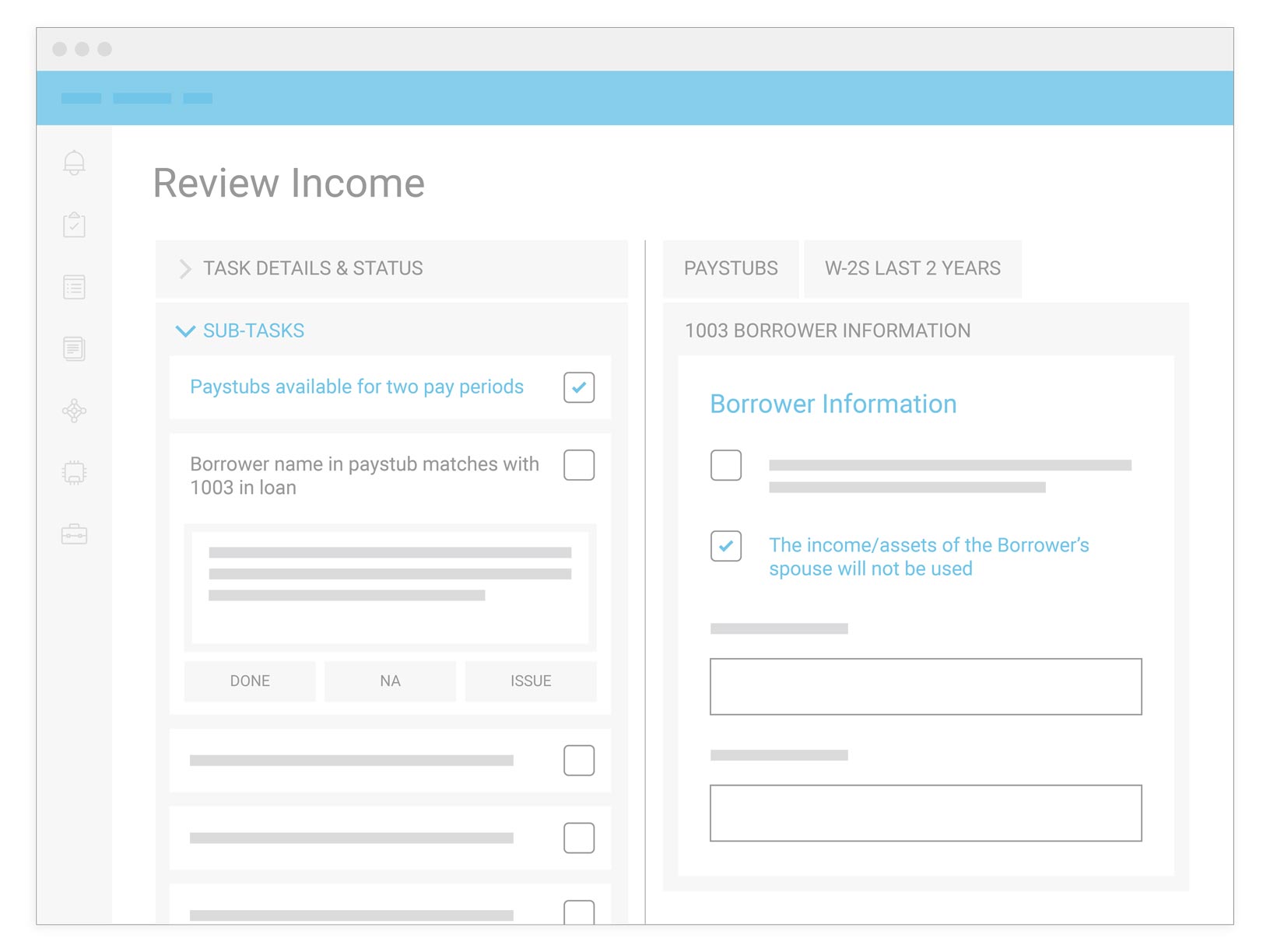

Accelerate the application process with the ability to seamlessly run credit reports and get online verification of assets, employment and income

Easy-to-use online application for borrowers

Easily complete mortgage applications online and from any device

Drive more business with better automation and customization

- Utilize a modern digital mortgage workflow that streamlines everything from online applications to data collection.

- World class security comes baked in with all of the ICE Mortgage Technology® family of products, giving you greater peace of mind.

- Automatically receive compliant applications, underwritten by Fannie Mae’s Desktop Underwriter® or Freddie Mac’s Loan Product Advisor℠, and enable services.

- Increase your online brand presence with a customized interface and template.

- Get alerts to any compliance obligations, even with incomplete applications.

Simplify the borrower experience

- Modern, responsive design lets borrowers fill out a simple, conversational style loan application and easily interact with your site from any device.

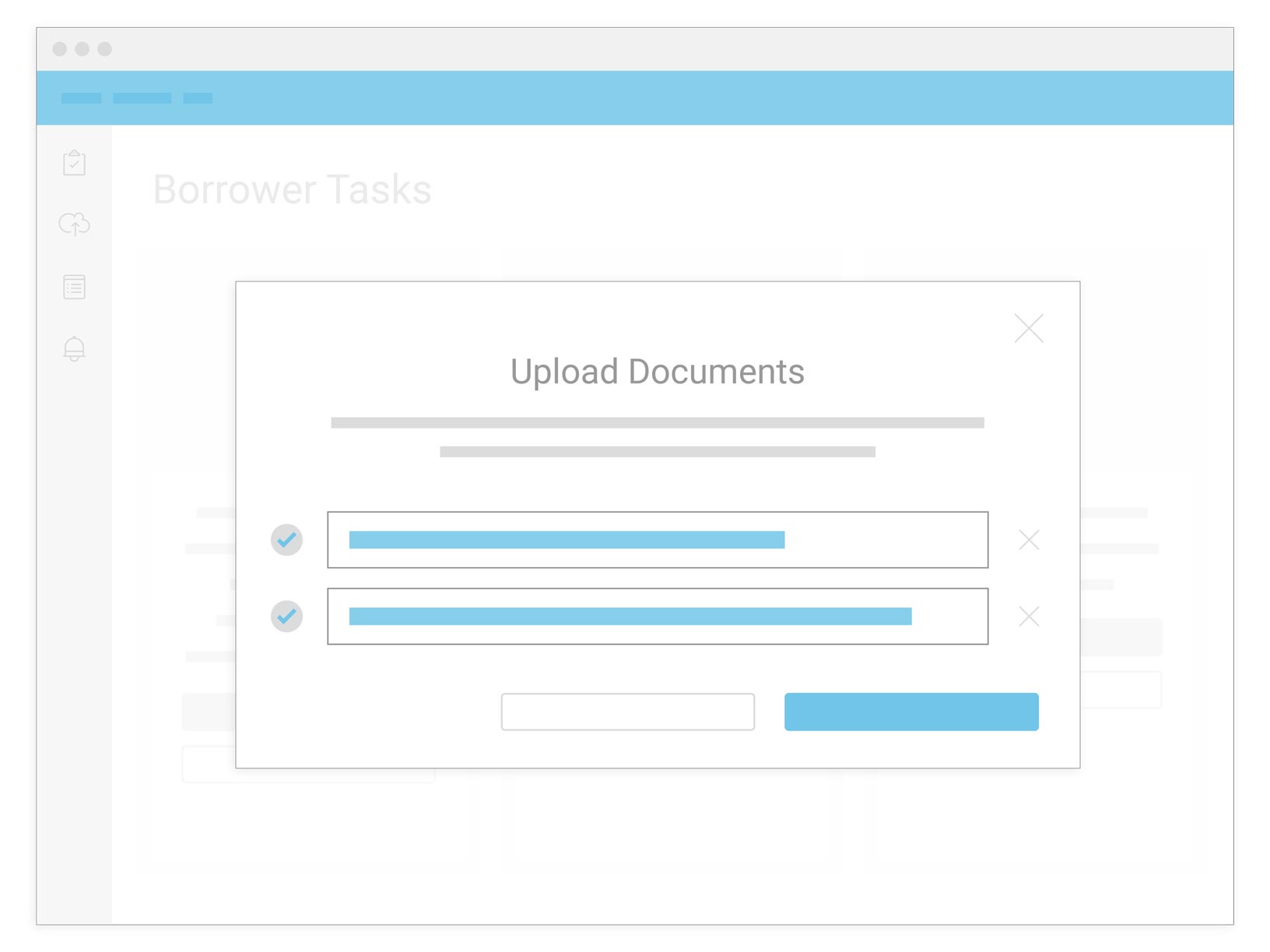

- A paperless way to collaborate with your team, securely send and receive documents, and share financial information.

- Borrowers can accelerate the application process by running their own credit reports, getting online verification of assets, and eSigning documents.

Learn more“By accessing Encompass from anywhere, our loan officers can get the app, finish it, price it, and be first to the finish line. In a lending environment where your ability to respond quickly to borrower applications is often a deciding factor on your ability to win the business, the Encompass platform’s ability to quickly act on new applications has given us a major competitive advantage.”

Brandon Durham,

Product Support Manager

Streamline every step of the mortgage process

ICE Mortgage Technology® delivers a true digital mortgage experience across your entire workflow. Our technology enables mortgage professionals across the industry to focus on personal connections where they need them most.

Real Estate

Easy-to-use, next generation solutions that help real estate professionals, MLSs and title companies generate more business, increase productivity, strengthen relationships and deliver a competitive edge in today’s market.

Lead Generation

Proven and cost-effective lead generation solutions that help mortgage and real estate companies grow their businesses. Experience the benefits of intuitive, industry-leading technology, data and analytics designed to identify targeted opportunities and support your customer-acquisition goals.

Loan Application

Our complete suite of solutions allow your teams to operate efficiently and maintain compliance with streamlined processes, powerful communication capabilities and improved functionality.

Loan Processing

Advanced technologies that will help you create a consistent, uniform loan origination process to drive efficiency and improve loan quality. With our solutions, you have the ability to process mortgage applications with higher accuracy and achieve a better customer experience.

Closing & Settlement Services

Electronically connect people, technologies and data in your real estate transactions. Electronic services save you time and money and simplify processes from pre-closing through post-closing.

Capital Markets

Data and analytics that help create efficiencies and cost savings for professionals who operate in the capital markets space. Our solutions help bank and non-bank mortgage servicers, investors and management firms make informed business decisions based on real-world market data.

Servicing

Best-in-class servicing solutions to help manage all aspects of loan servicing — from loan boarding to default. Transform your performance with automation and insights, and enhance the customer experience. Our solutions support first mortgages as well as home equity loans, and help servicers lower costs, reduce risk and operate more efficiently.

Retention

Integrated solutions to better support your customers. Our digital capabilities can help you proactively engage with customers to increase satisfaction and drive retention. Use our robust analytics and advanced marketing automation solutions to deliver the right messages at the right time.

Risk Management

Comprehensive solutions that help mortgage and title professionals reduce loss. Use our data and analytics to uncover potential risk to the properties in your portfolio or those that you are preparing for title and settlement. Our industry-leading solutions include reliable data, offer an intuitive experience and deliver the insights needed to help proactively prevent risk.

Valuations

Comprehensive suite of market-leading valuation solutions that support the entire real estate and mortgage loan life cycle. Appraisers, lenders, servicers, investors and real estate agents rely on our valuation products to help them meet their specific business goals.

Business & Market Intelligence

Actionable intelligence to help you make smarter, more informed decisions. Combined with our extensive data assets and proprietary analytics, you can expand your operational view to help increase efficiencies, generate and protect revenue and support compliance requirements.

Benchmarking

Expansive mortgage and housing-related data assets and analytics to help you more accurately benchmark performance. Our solutions include servicer-contributed loan level data; default, prepayment and loss predictive models; comprehensive valuation solutions; and more.

Portfolio Management

Comprehensive suite of mortgage portfolio management solutions. Maximize profitability, effectively manage risk, support regulatory compliance, identify opportunities and improve decision-making.

Partner Network/Integrations

With the largest network of integrated partners in the industry, ICE Mortgage Technology® helps you extend your business by connecting you to thousands of mortgage professionals.

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

See how we ensure a smooth and efficient rolloutTake your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass for Loan Officers

Empower your loan officers to drive more business and deliver better borrower experiences.

Encompass TPO Connect®

Optimize how you receive and manage loans from your Third-Party Originators.

Encompass CRM™

Generate leads, build relationships, grow faster, and stay compliant.

Encompass eClose

One source. One workflow: The future of closings is here.

Encompass Product & Pricing Service™

Loan pricing in an instant, with total confidence.

Encompass Investor Connect™

Loan delivery, funding, and purchases- fast.

Encompass Data Connect®

Do more with your data, anytime and anywhere.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

Home Equity

Connect Encompass and Salesforce to create a true digital mortgage platform.

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

See all resources