An end-to-end software system that handles every servicing need

MSP®, ICE’s best-in-class loan servicing software, has set the industry standard and is unmatched, due to a strong focus on regulatory compliance and risk, protection of borrower-owned data, decades of proven performance and a commitment to continuous innovation. MSP offers servicers of all sizes the ability to tackle today’s most pressing business challenges.

GET STARTEDMore servicers choose MSP than any other loan servicing software

Our mortgage servicing platform is used by financial institutions that service first mortgages, along with home equity loans and lines of credit. These include banks, mortgage companies, credit unions, housing agencies and more.

MSP® Digital Experience: A revolutionary new conversational interface for the industry’s leading loan servicing system

LEARN HOW MSP DX IS MAKING SERVICING SIMPLE

Advanced capabilities for an unparalleled customer experience

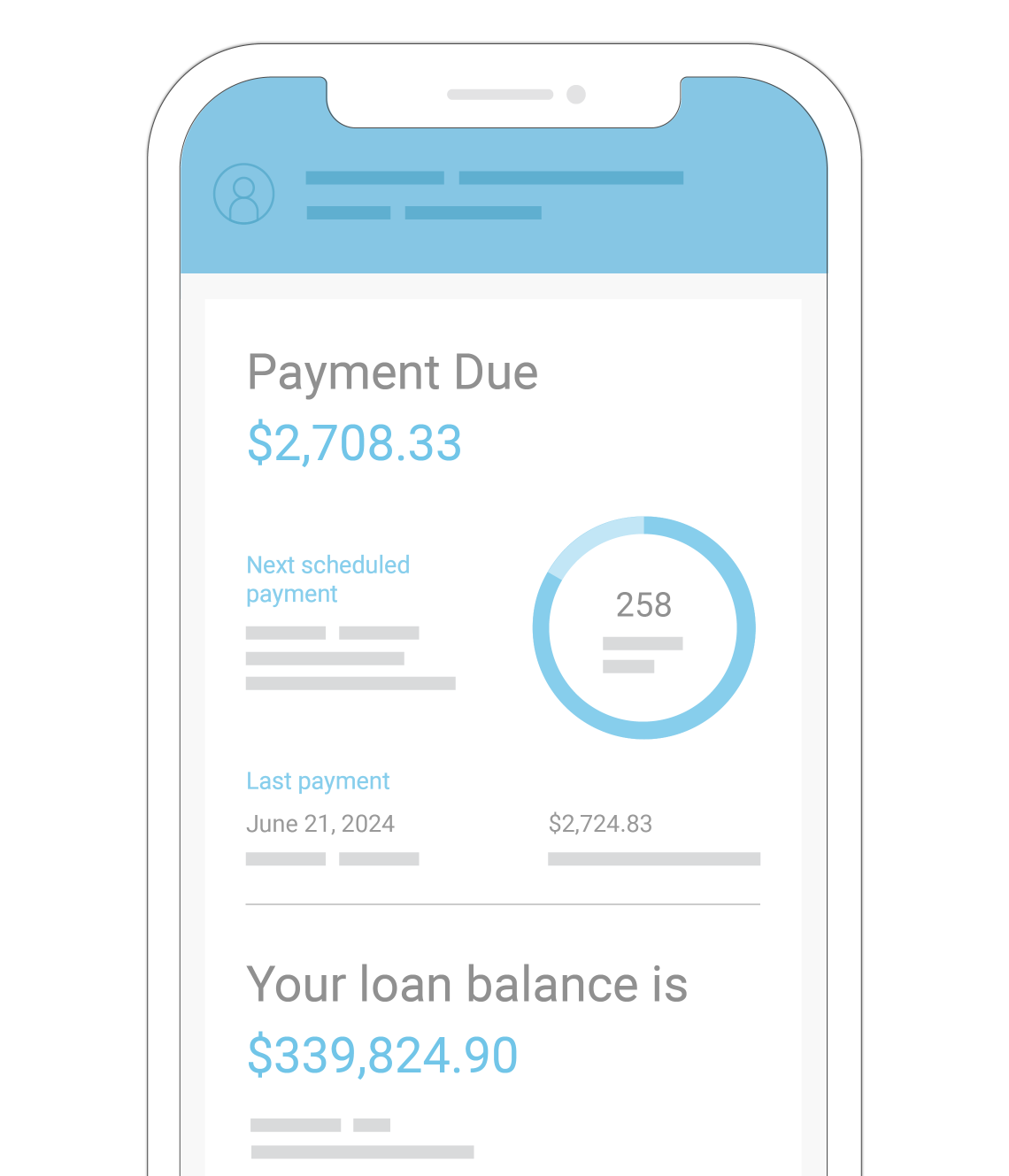

Customers want quick and simple access to their loan and property-related information – anytime, anywhere. MSP integrates with Servicing DigitalTM, ICE’s consumer-facing native app and responsive web solution, to give borrowers 24/7 access to highly personalized home, loan and neighborhood information. And when borrowers call for support, Customer ServiceTM quickly provides your agents with relevant information about the customer’s loan, helping them quickly and efficiently resolve many issues in just one call.

servicing digitalcustomer service

Do more with the team you have

MSP is continually enhanced to deliver the latest advancements in digital technology, workflow automation and decisioning capabilities. Supporting efficient processing from loan boarding to disposition, MSP helps your back-office teams work seamlessly across functional areas to drive performance, reduce costs, and improve communication and collaboration.

Automated Lien ReleaseLoan Boarding

Actionable Intelligence Platform

The right technology, right when you need it

MSP supports several types of integrations, including digital application programming interface (API) integrations, so users can rapidly access data and services. Servicers can also leverage the ICE InterChange ServicesTM electronic data interchange (EDI) network, with more than 400 providers already integrated to ICE's servicing technologies.

Servicing APIsDeveloper Portal

InterChange Services

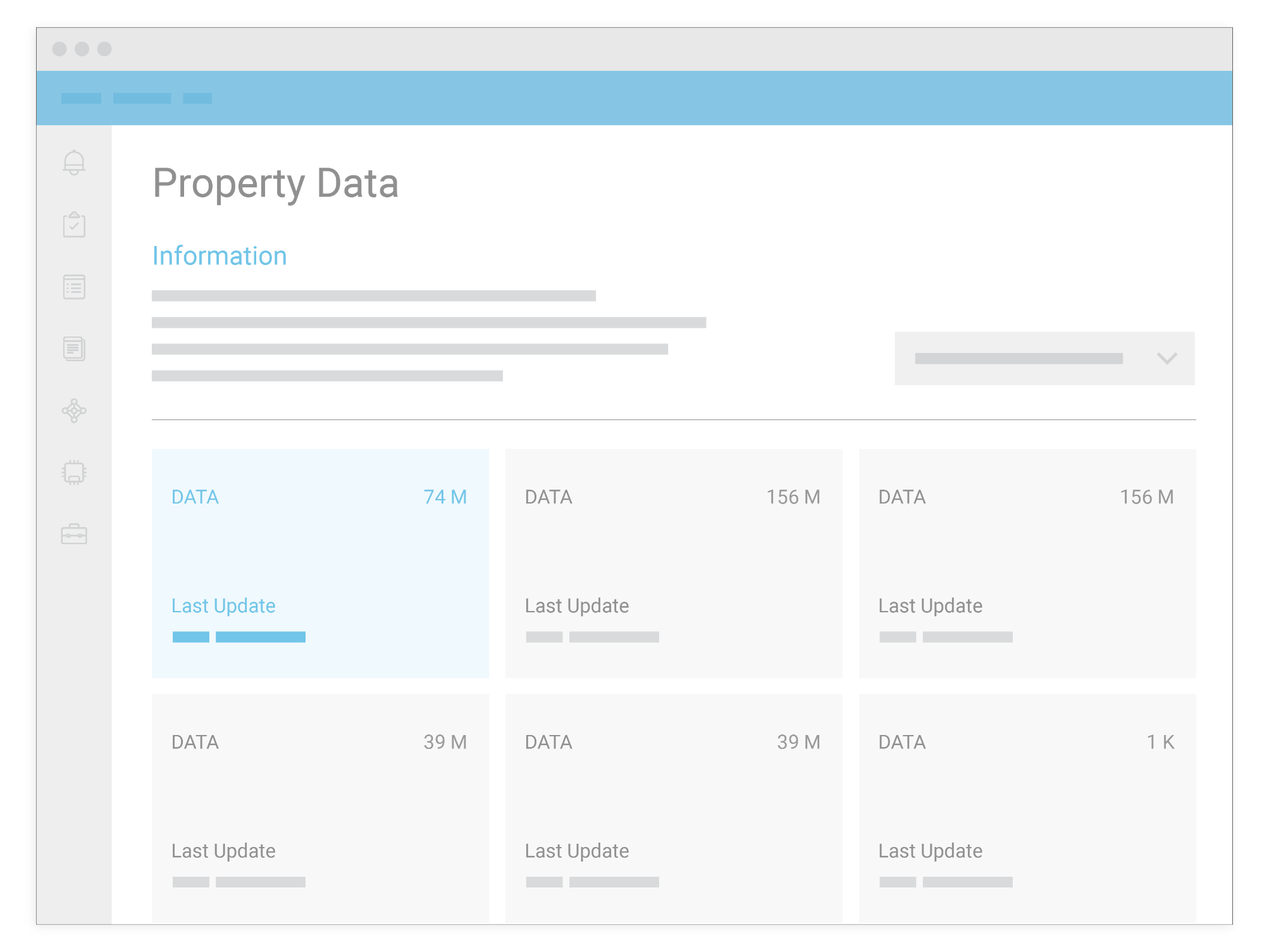

Help homeowners realize their potential in an equity-laden market

With MSP, servicers can handle home equity loans and first liens on a single platform. Plus, the integration of ICE's robust dataset with MSP helps servicers identify customers in their portfolio who are most likely to take advantage of home equity loans and lines of credit. This data can also help during loss mitigation, as strong home equity cushions provide borrowers incentive to work with their servicers to return to making mortgage payments.

Property DataLoss Mitigation

Technology helps servicers find opportunities in unusual places

Read our complimentary white paper to learn how you can gain critical insights to better meet your customers’ needs, while simultaneously driving efficiency in your back office.

Download the white paperExplore more resources

MSP in the news

Capital Mortgage Services selects MSP® loan servicing system from ICE

Read nowICE Redefines Mortgage Servicing for Industry Professionals with New Intelligent, Conversational Interface

Read nowLennar Mortgage Moves Servicing Operations to ICE Mortgage Technology for Seamless Systems Integration

Read nowTake your MSP experience to the next level

Leverage integrated servicing solutions to make smarter business decisions, lower costs and drive innovation across all your channels.

Automated Lien Release

Accelerates the lien release process by combining document creation and automated workflows into one solution.

Bankruptcy

A flexible, scalable solution that uses workflow and servicer-defined rules to automate bankruptcy-related tasks.

Claims

Streamline default-related claims processing by centralized claims information across payers into a single, user-friendly application.

Collections

Streamline the process of collecting delinquent payments.

Developer Portal

Self-service solution that provides centralized access to all APIs.

Foreclosure

A streamlined and scalable solution that uses workflow and servicer-defined rules to automate the various foreclosure-related tasks.

Interchange Services

The industry’s largest value-added electronic data interchange (EDI) network dedicated to the exchange of mortgage servicing data.

Invoicing

Web-based default application that helps simplify billing and invoice processes through automation.

Lien Alert

Efficient, cost-effective portfolio-monitoring solution delivering early notifications of critical property-, borrower- or mortgage-related events that could impact collateral supporting your loans

Servicing Vault

Standardized digital document storage across servicing solutions.