Streamline the process of boarding new and acquired loans

Loan Boarding™ provides the scalability, flexibility and controls to help you effectively board new and acquired loans onto the MSP® loan servicing system. With robust data conversion and mapping capabilities, plus advanced data protection, Loan Boarding can help save time and improve data integrity.

GET STARTEDEffectively board new and acquired loans onto the MSP loan servicing system with scalability, flexibility and control

With the flexibility to apply your own business rules, Loan Boarding converts the source data as it is received from the previous servicer into a standard format to reliably and consistently convert into MSP. Additionally, a function library provides advanced data mapping techniques to assist users with mapping source data. With Loan Boarding, you can tailor loan data conversion processing to meet your organization's customized conversion, reporting and validation needs.

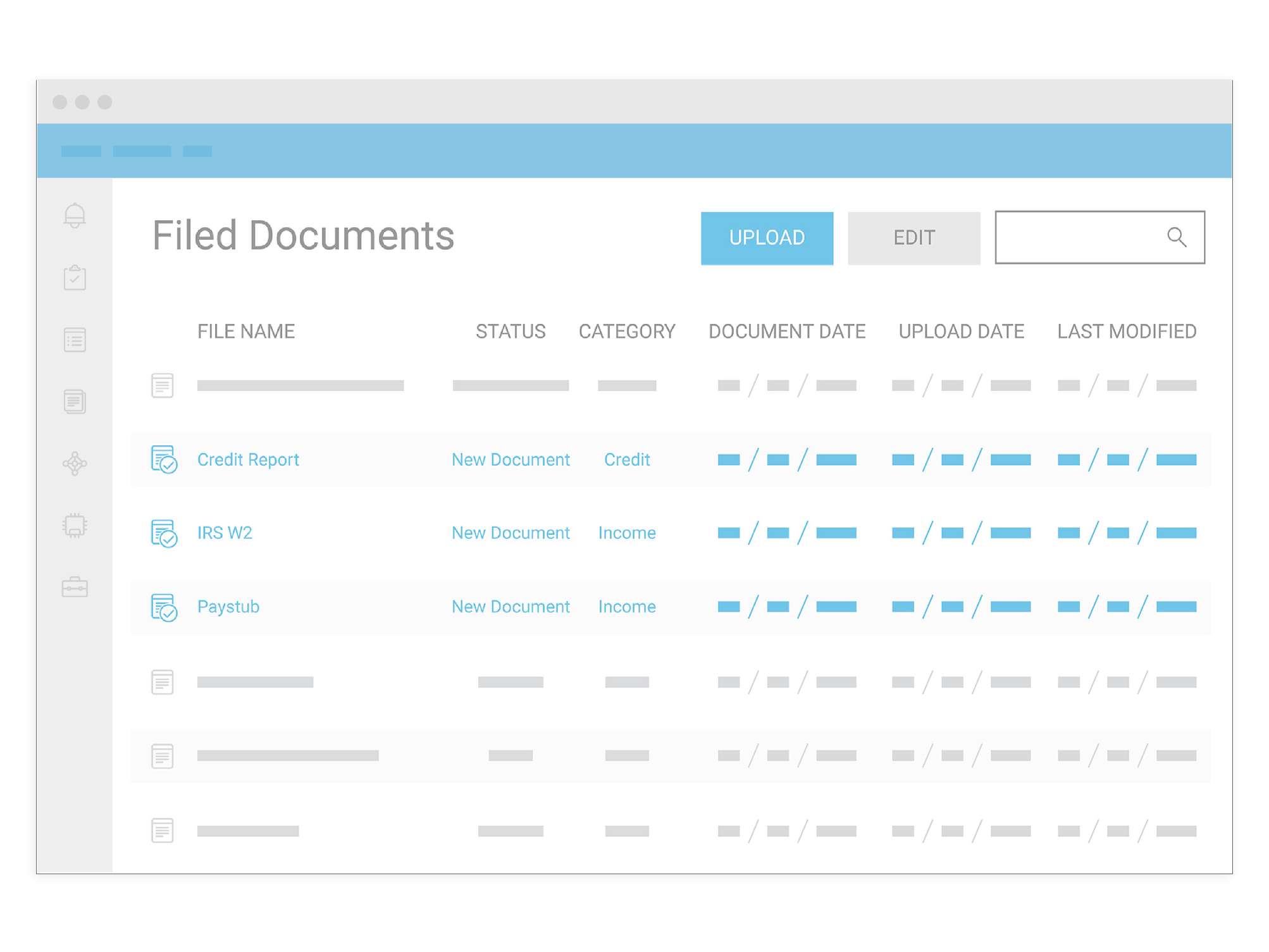

Automate the intake and classification of critical loan documents

Whether boarding a newly originated loan or a seasoned loan as part of a servicing transfer, ICE’s Document Automation solution introduces new efficiencies in the traditionally cumbersome process of intaking and classifying critical loan documents. The solution intakes and splits — or “de-blobs” — critical documents, and then names them according to standard conventions.

Learn more