A suite of Fannie Mae solutions integrated within Encompass

Drive a more efficient lender and borrower experience using Fannie Mae solutions within Encompass®. Through these integrations and with additional workflow options, lenders can originate loans quicker, lower costs, and reduce time to close.

GET STARTED“ICE Mortgage Technology is a key partner for us. They are a front door for access to Fannie Mae’s products. The tools that we’re able to bring to market in our partnership can really enable process efficiencies and a better borrower experience.”

Cindy Keith

Director, Product Development, Fannie Mae

Fannie Mae solutions integrated within Encompass include

- Desktop Underwriter® (DU®) & Desktop Originator® (DO®)

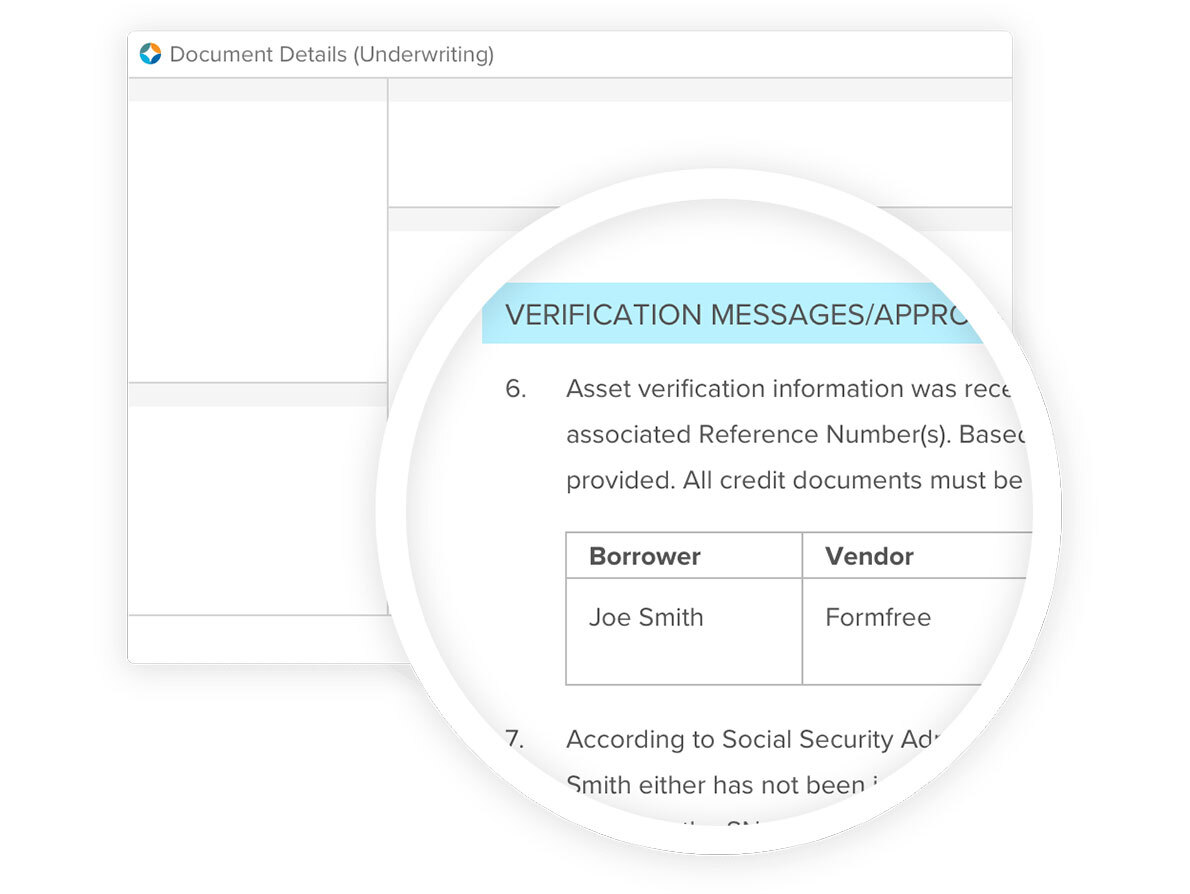

Delivers an in-depth eligibility and credit risk assessment, while providing freedom from many reps and warrants (Day 1 Certainty®) and greater speed and simplicity for property value, income, asset, and employment - EarlyCheck™

Helps identify potential eligibility and/or data issues at any point in the loan origination process - Uniform Collateral Data Portal® (UCDP®)

A single portal for electronic submission of appraisal reports - UCD Collection Solution

Confirms that closing data meets Fannie Mae eligibility requirements and enables transfer to correspondent investors - Desktop Underwriter & EarlyCheck Automated Workflow Streamline processes to save time and reduce manual effort