Optimize how you receive and manage loans from your Third-Party Originators (TPOs)

Maximize volume and profitability using Encompass TPO Connect® in your wholesale and correspondent channels

GET STARTED Read datasheetTPO Connect enables fast, complete and compliant loan acquisition, and collaboration

TPO Connect is a web-based portal featuring your company branding and content, enabling you to easily create your own TPO acquisition portal.

Enable correspondent lenders to achieve better ROI and loan savings

Correspondent solutions, Encompass and Encompass TPO Connect allow for maximum efficiency, scalability and profitability

Delivers 10.8x annual ROI

- Scale operations and improve capacity by 28%

- Process 1,414 more loans per year without additional resources

Save $654 per loan

- Save an average of 498 minutes per loan

- Speed funding by a full day

“Having a system like Encompass TPO Connect that links you with your TPO partners and lets them know that they’re valued as customers is critical to winning more business.”

Lorenzo Adams

Vice President of Operations

First Community Mortgage

Deliver a first class experience for your TPOs

TPO Connect enables you to give your lenders and sellers an optimal way to collaborate.

Maximize profitability and collaboration with your TPO channels

- Increase your pipeline and attract customers with an easy to use branded portal

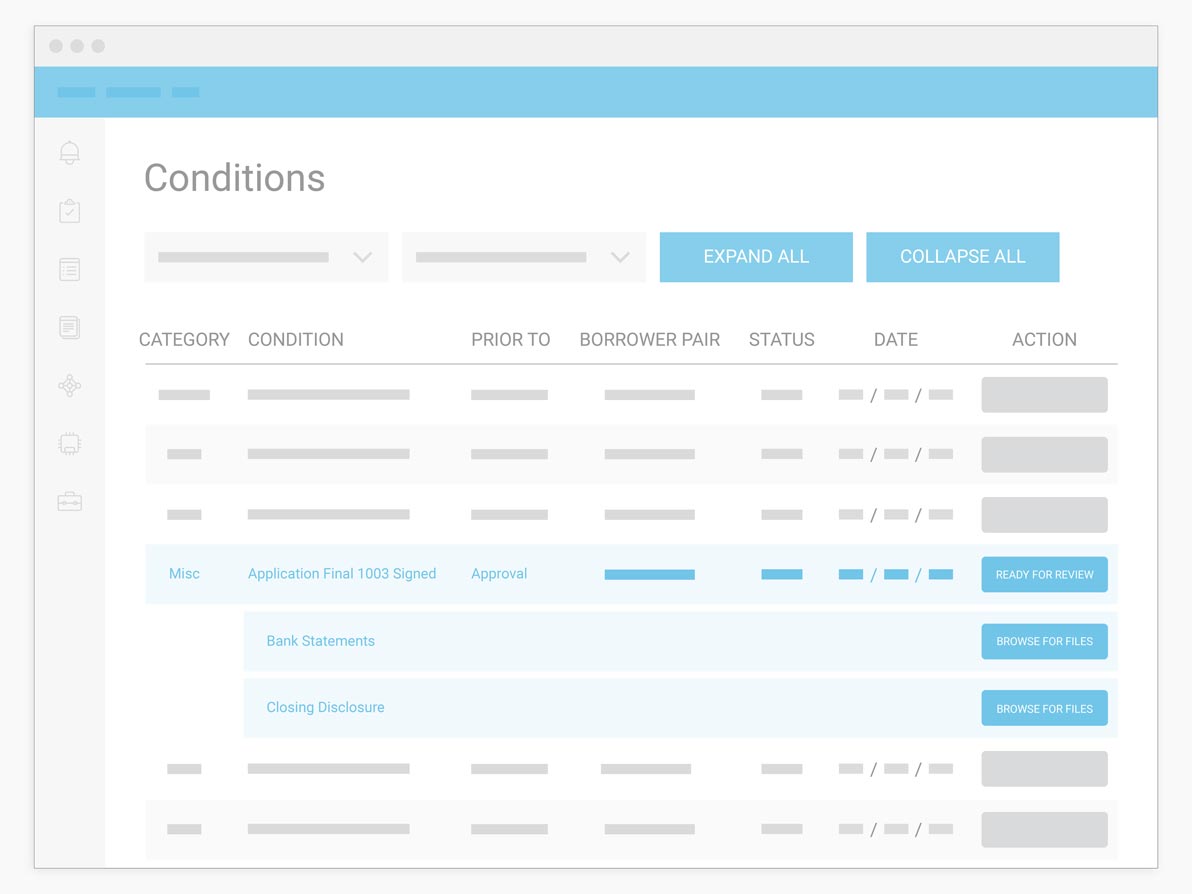

- Receive loans faster and improve collaboration by giving your TPOs an easy way to manage and deliver loans

- Close and purchase higher quality loans faster by bringing your TPO channel into Encompass

Improve TPO collaboration, and give them the ability to:

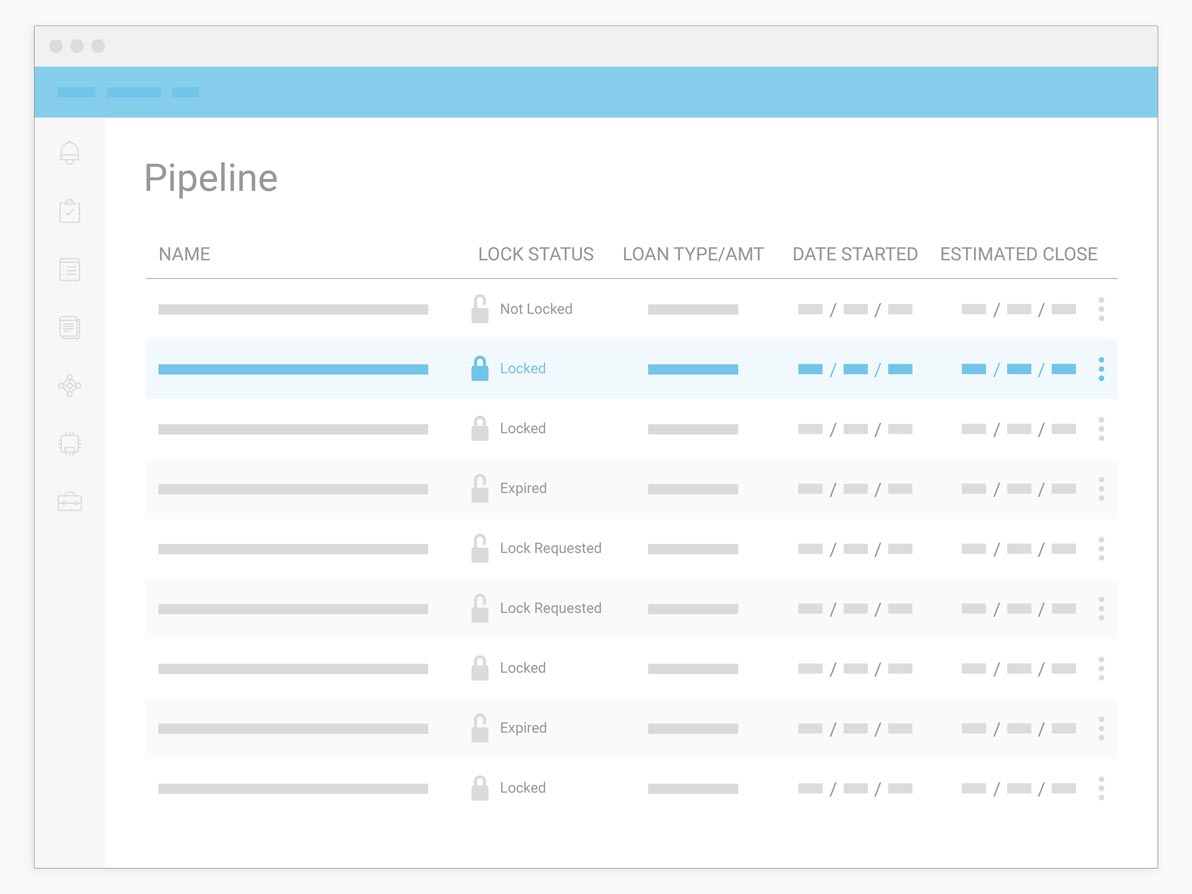

- View pipeline reports and monitor status

- Order credit, AUS, submit lock requests

- Deliver and eSign loan packages

- View and manage correspondent trades

Streamline every step of the mortgage process

ICE Mortgage Technology® delivers a true digital mortgage experience across your entire workflow. Our technology enables mortgage professionals across the industry to focus on personal connections where they need them most.

Real Estate

Easy-to-use, next generation solutions that help real estate professionals, MLSs and title companies generate more business, increase productivity, strengthen relationships and deliver a competitive edge in today’s market.

Lead Generation

Proven and cost-effective lead generation solutions that help mortgage and real estate companies grow their businesses. Experience the benefits of intuitive, industry-leading technology, data and analytics designed to identify targeted opportunities and support your customer-acquisition goals.

Loan Application

Our complete suite of solutions allow your teams to operate efficiently and maintain compliance with streamlined processes, powerful communication capabilities and improved functionality.

Loan Processing

Advanced technologies that will help you create a consistent, uniform loan origination process to drive efficiency and improve loan quality. With our solutions, you have the ability to process mortgage applications with higher accuracy and achieve a better customer experience.

Closing & Settlement Services

Electronically connect people, technologies and data in your real estate transactions. Electronic services save you time and money and simplify processes from pre-closing through post-closing.

Capital Markets

Data and analytics that help create efficiencies and cost savings for professionals who operate in the capital markets space. Our solutions help bank and non-bank mortgage servicers, investors and management firms make informed business decisions based on real-world market data.

Servicing

Best-in-class servicing solutions to help manage all aspects of loan servicing — from loan boarding to default. Transform your performance with automation and insights, and enhance the customer experience. Our solutions support first mortgages as well as home equity loans, and help servicers lower costs, reduce risk and operate more efficiently.

Retention

Integrated solutions to better support your customers. Our digital capabilities can help you proactively engage with customers to increase satisfaction and drive retention. Use our robust analytics and advanced marketing automation solutions to deliver the right messages at the right time.

Risk Management

Comprehensive solutions that help mortgage and title professionals reduce loss. Use our data and analytics to uncover potential risk to the properties in your portfolio or those that you are preparing for title and settlement. Our industry-leading solutions include reliable data, offer an intuitive experience and deliver the insights needed to help proactively prevent risk.

Valuations

Comprehensive suite of market-leading valuation solutions that support the entire real estate and mortgage loan life cycle. Appraisers, lenders, servicers, investors and real estate agents rely on our valuation products to help them meet their specific business goals.

Business & Market Intelligence

Actionable intelligence to help you make smarter, more informed decisions. Combined with our extensive data assets and proprietary analytics, you can expand your operational view to help increase efficiencies, generate and protect revenue and support compliance requirements.

Benchmarking

Expansive mortgage and housing-related data assets and analytics to help you more accurately benchmark performance. Our solutions include servicer-contributed loan level data; default, prepayment and loss predictive models; comprehensive valuation solutions; and more.

Portfolio Management

Comprehensive suite of mortgage portfolio management solutions. Maximize profitability, effectively manage risk, support regulatory compliance, identify opportunities and improve decision-making.

Partner Network/Integrations

With the largest network of integrated partners in the industry, ICE Mortgage Technology® helps you extend your business by connecting you to thousands of mortgage professionals.

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

See how we ensure a smooth and efficient rollout“The flexibility of TPO Connect gives us what we need to provide a better customer experience; from making it easier to onboard loans to providing timely information to our TPOs and giving them the tools they need to manage their pipeline.”

Rick Q. Chin,

Vice President of Lending Solutions, PHH Mortgage

Take your Encompass experience to the next level

Leverage solutions across the Encompass platform to make smarter business decisions, lower costs, and drive innovation across all your channels.

Encompass Consumer Connect®

Borrowers expect an engaging online experience. Are you delivering?

Encompass for Loan Officers

Empower your loan officers to drive more business and deliver better borrower experiences.

Encompass CRM™

Generate leads, build relationships, grow faster, and stay compliant.

Encompass eClose

One source. One workflow: The future of closings is here.

ICE PPE (Product and Pricing Engine)

Loan pricing in an instant, with total confidence.

Encompass Investor Connect™

Loan delivery, funding, and purchases- fast.

Encompass Data Connect®

Do more with your data, anytime and anywhere.

Encompass Connector® for Salesforce®

Connect Encompass and Salesforce to create a true digital mortgage platform.

Home Equity

Connect Encompass and Salesforce to create a true digital mortgage platform.

Resources

Learn more about how ICE Mortgage Technology® is changing the industry and stay up-to-date with the latest tools and information.

See all resources

Amerihome Mortgage Case Study. Increase loan productivity by 25%

First Community Mortgage Case Study. Reduce cycle time and improve the user experience