At ICE Mortgage Technology, our mission is to automate everything automatable in the residential mortgage industry. In pursuit of this mission, we’re constantly looking for new, innovative ways to automate traditionally manual, time-consuming tasks that hinder productivity and take you away from what really matters – growing your business. With the recent influx of refinance volume, we know now, more than ever, that mortgage companies need technology solutions that can help make their workflows more efficient, so they can handle the increase in customer demand. That’s why we’re thrilled to introduce a new way for lenders and investors to simplify their workflows and automate manual repetitious tasks.

Introducing our new task-based workflow.

In the 21.1 Major Release, we released a new task-based workflow exclusively in the desktop version of Encompass LO Connect™. This new workflow model enables lenders to easily orchestrate, delegate and automate the completion of tasks across any user, at any stage of the loan lifecycle, and at any time. The traditional mortgage model, where each stage of the process is managed one at a time, creates bottlenecks and inefficiencies because each stage in the process cannot commence until the previous stage has been completed. With our task-based workflow, teams can now reimagine the current paradigm of mortgage management and easily complete tasks across multiple stages in parallel within tailored workspaces that contain everything a user needs to do their job. Based on customer feedback, we believe the new task-based workflow will enable lenders and investors to more efficiently manufacture and acquire loans, complete milestones faster, collaborate more effectively, as well as dramatically reduce time to close and time to purchase.

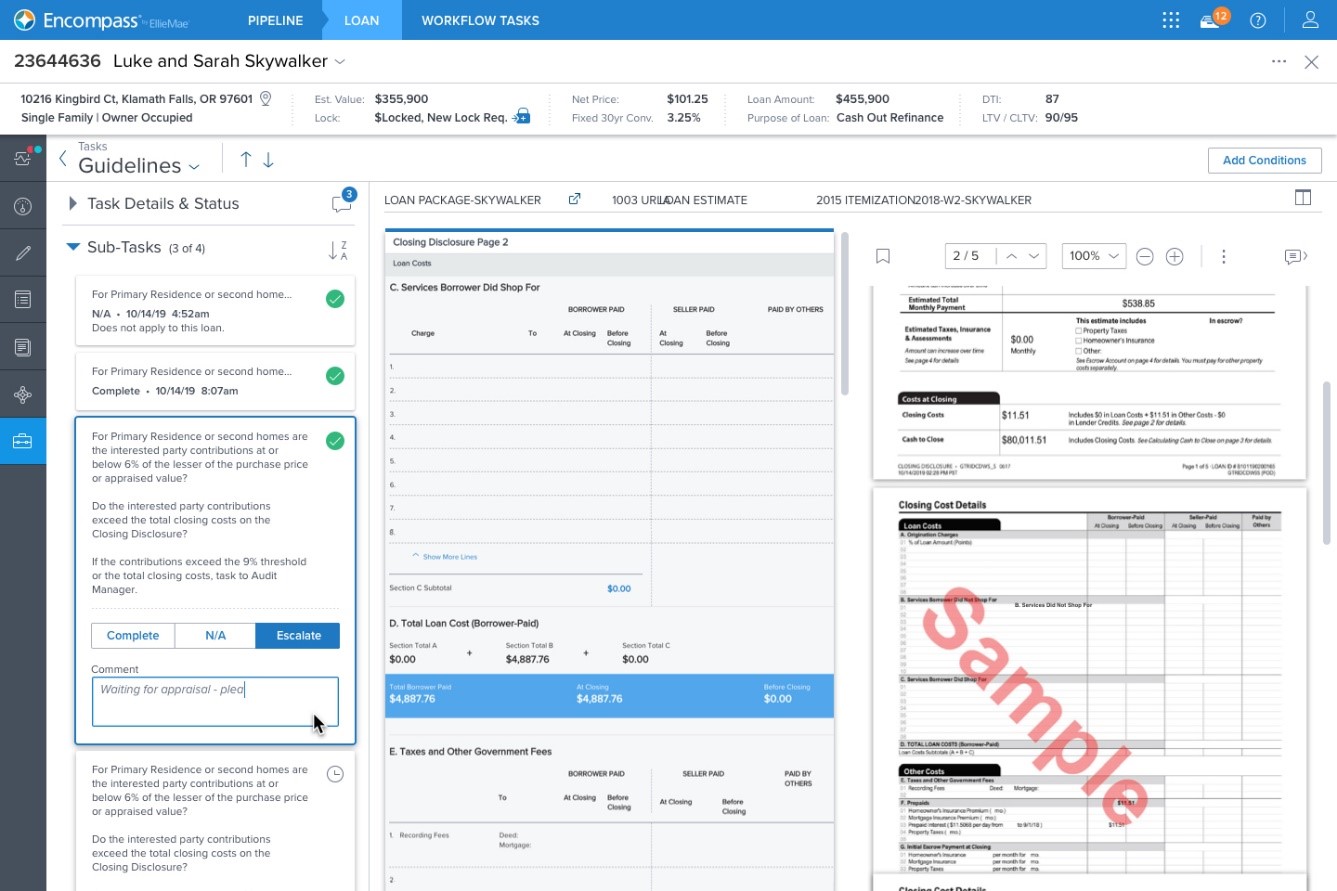

Figure 1: The new task-based workflow in Encompass

Our new task-based workflow helps mortgage companies in four primary ways:

- Digitize and streamline the management of all of your tasks.

For years, many if not most lenders and investors have used check-list systems to manage the completion of all the tasks need to close or acquire a loan. The problem is that the project management of the tasks and collaboration across teams occurs outside of their loan origination system (LOS) in excel spreadsheets, third party project management software and sometimes even paper. This makes things more complex and prone to error. In Encompass® today, we give you the ability to assign tasks to milestones, but there are limits to what you can do and it often requires customization.

With our new task-based workflow, we’re enabling you to manage, assign and check the status of your tasks - all from a single system of record. It can enable managers to delegate work to their employees with greater efficiency, monitor the status of each task and ensure consistency throughout each step of the process. And for front line employees, it means their work will be less prone to error and more visible to others in their organization.

Provide customers with more options for the sequence of how tasks are completed.

Historically, mortgages have been originated or acquired in a sequential process that largely resembles an assembly line – with each person handing off parts of the process to the next. Although this operating model has been the standard for decades, clearly it isn’t optimized for efficiency because it requires one person to do their entire body of work before handing it off to the next. For example, in many instances, the underwriter can’t start their part of the process until the processor finishes theirs - which can add days to the overall manufacturing cycle.

With the task-based workflow, we’re giving lenders and investors a way to remove these bottlenecks and provide their users with a framework to work on any task across any stage or milestone, at any point of the loan process. By allowing your teams to work on multiple tasks across the process at the same time, we’re enabling them to complete milestones faster and drastically shorten your time to close.

Simplify how originators and operations employees work on loan tasks.

Many lending solutions require users to navigate across multiple areas of the application in order to complete their tasks. For example, the application might be on one page, the relevant documents might be in another area and tools to run calculations for the application might be in yet another location. This is certainly not the most efficient user experience.

With our new task-based workflow, we’ve introduced the concept of Task Workspaces – A one-stop shop interface for everything a user needs to complete their tasks; including documents and forms, conditions, tools and the ability to flag issues to their managers. This means no more navigating to multiple screens to complete a given task. Everything users need is now in one spot.

Automate the creation and completion of tasks for your employees.

Many lending technology providers claim they provide workflow automation. But in many cases, it’s limited to automating granular steps within a process like calculating fees or copying fields. As a result, if you want to automate workflows above and beyond fees and fields, you often have to write advanced code which may require custom development and/or software engineering resources.

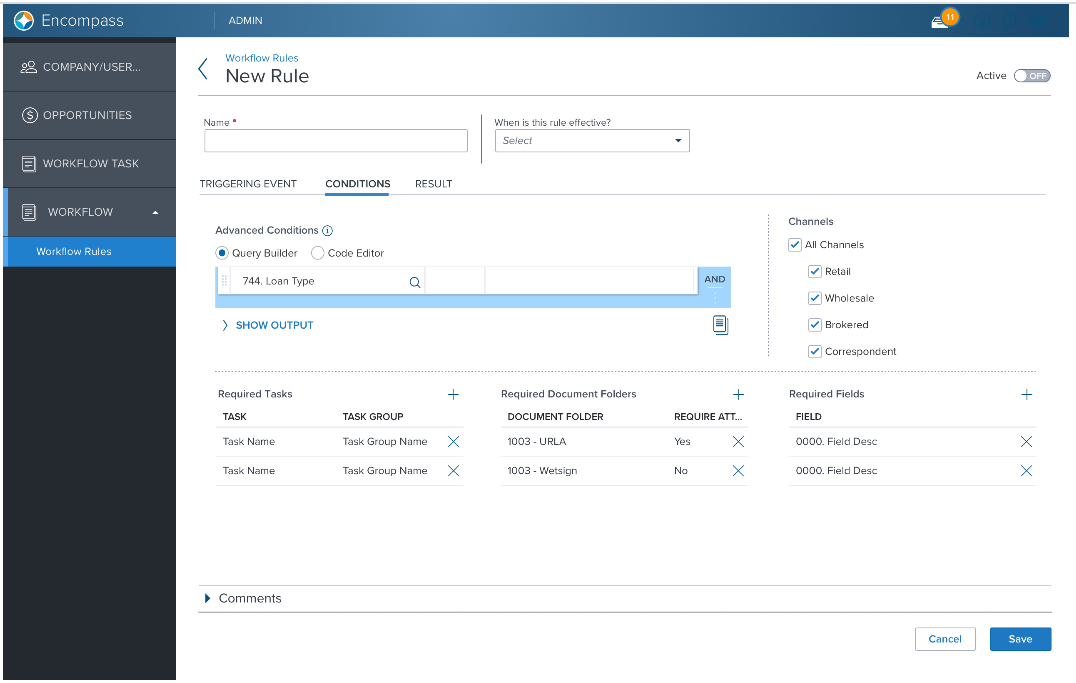

As part of our task-based workflow initiative, we’ve introduced a new automation engine that allows you to easily configure rules to dynamically create or complete tasks based on events that occur within the loan or task. This means you’ll be able to automate entire tasks or even entire processes (like ordering disclosures) instead of just small elements of the tasks (like calculating fees for disclosures). It also paves the way for customers to adopt a truly exception-based workflow. This allows customers to automate a substantial part of their workflow, as well as manage whatever they choose not to automate with an exception-based process.

Figure 2: Creating new workflow rules in Encompass

We’re tremendously excited about the potential our new task-based workflow has to change the paradigm of how mortgage companies work. With this step forward, ICE Mortgage Technology is moving significantly closer to our north star vision of automating everything automatable within the mortgage process. Best of all, consistent with all of our other products, it’s flexible and easy to configure for any channel, any role and any workflow. We’ve worked closely with our customers throughout the product development process and so far, feedback has been tremendously positive. We expect a substantial number of our customers to adopt the task-based workflow in 2021.

Tips for getting started:

If you’re a current ICE Mortgage Technology customer, we encourage you to leverage these helpful resources to learn more about our new innovative capabilities for driving workflow automation:

- Review the 21.1 Major release notes

- Explore our helpful materials on the Encompass LO Connect Customer Resource Center, including “how to get started” videos and configuration guides

- Watch our on-demand Q4 2020 National Sys Admin Call webinar recording which includes an in-depth product demonstration on task-based workflow

- Attend Experience 2021, between March 8-26, to participate in several task-based workflow sessions (There’s no cost to register!)