The Work Number™ Partner Integration is a service integration provided by Equifax that allows loan officers and loan processors to verify employment and income for borrowers. Previously, this service was only available to lenders on the legacy EllieMae Network Platform. ICE Mortgage Technology™ recently partnered with Equifax to redesign and refactor this integration to take advantage of the improved user experience and automation capabilities offered by the new Encompass Partner Connect™ (EPC) platform and the new ICE Mortgage Technology Design System. This move to EPC also means that a single integration can be accessed from both the desktop and web versions of Encompass. The new integration went live on 1/8/22.

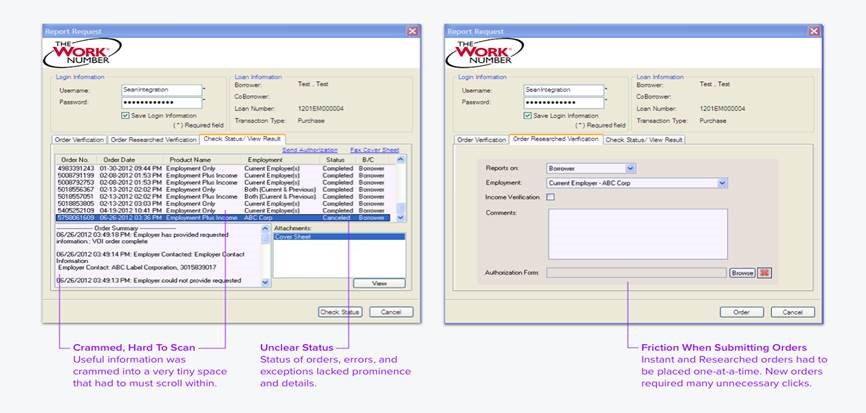

Before

The prior The Work Number integration with the EllieMae Network, which was targeted towards loan officers and loan processors to verify employment.

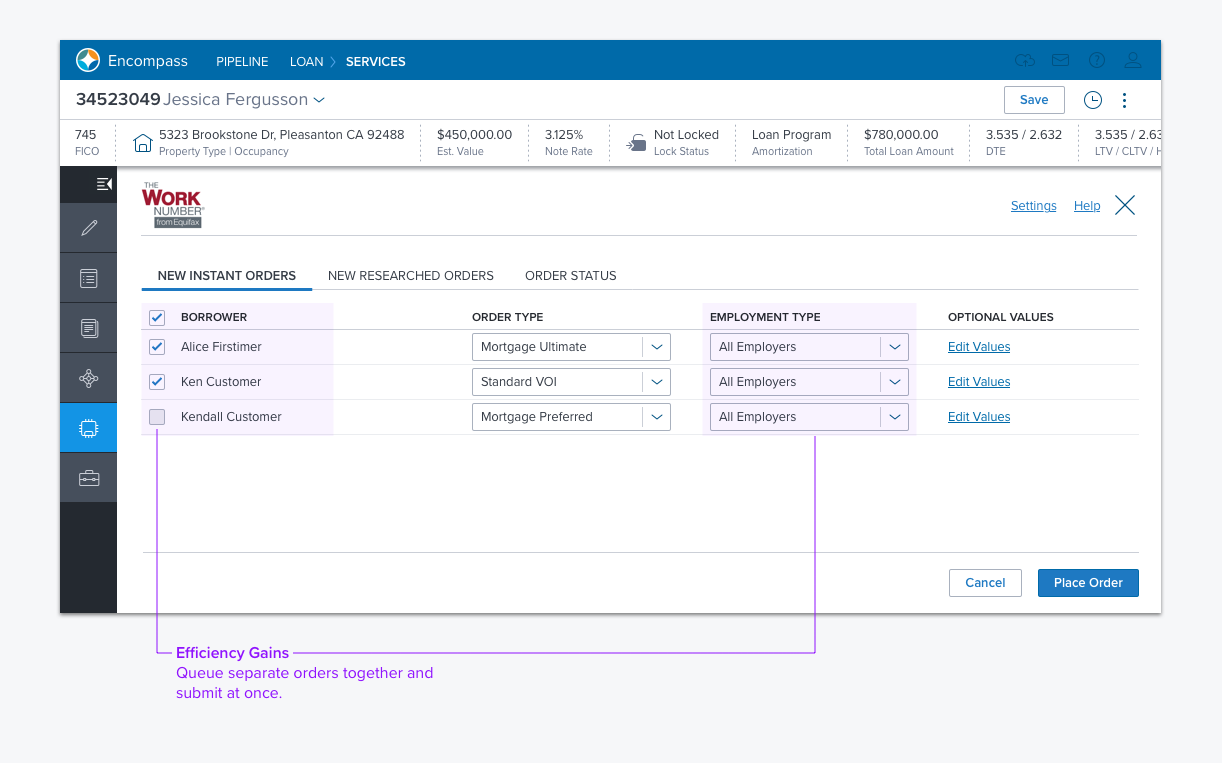

After

The new The Work Number integration, shown as part of Encompass Web and using the new visual style provided by the ICE Mortgage Technology Design System. Here, the user can more easily place their order.

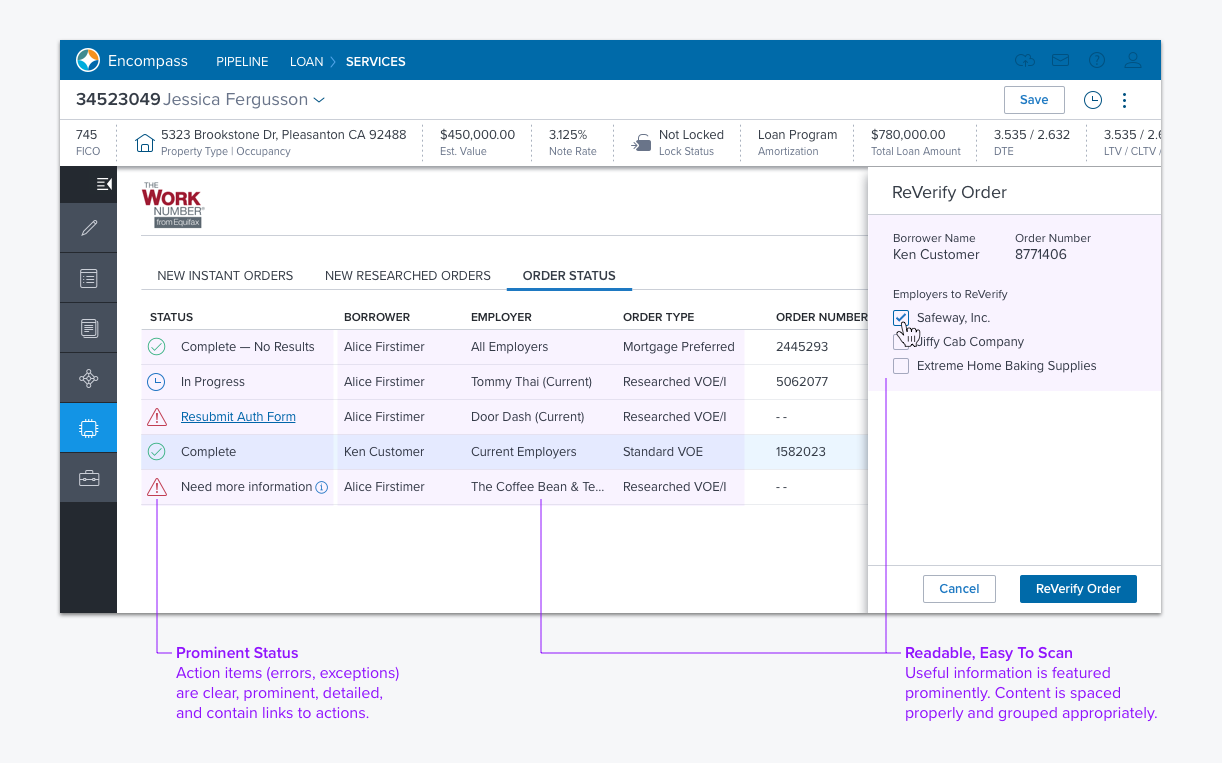

In this image of the new The Work Number integration, the order results are shown in an easy-to-read layout.

"By listening to clients' needs and incorporating their feedback, we've designed an interface that streamlines the loan origination process."

- Ashley Wood, VP of Mortgage Verification Services at Equifax Workforce Solutions.

“The flexibility we found in the ICE Mortgage Technology Design System empowered us to reimagine the entire design to really showcase the power of The Work Number service.”

- Troy Tomas, VP, Integrations Engineering

Making a better experience

Our User Experience team spent time brainstorming and asking questions of Product and Engineering. The big insight that occurred was around improving the efficiency of transactions.

A loan officer or processor needs to potentially place many orders in a single session. In the native smart client application, a user would have to individually submit and track each order and wait on feedback for each one. We asked the question: Can this experience be streamlined on the backend? Can we queue orders and send them as a single request – and have users receive just a single response? We learned we could make this improvement. Through the re-design process we went from 13 clicks to 3 for end users.

The results were exciting, with Equifax reporting the following productivity gains on a per-transaction basis on 08/20/2021:

| Time on Task | Level of Effort | |

| Old Integration | 1:12 | 13 Clicks |

| New Integration | 0:56 | 3 Clicks |

| Improvement | 22% | 77% |

How can I find out more?

- To learn about our ICE Mortgage Technology Design System, check out the Dim Sum website: https://dimsum-usage-guidelines.readme.io/

- To learn about Encompass Partner Connect, please visit our Developer Hub: https://docs.partnerconnect.elliemae.com/partnerconnect

- Equifax Press Release

- Inman News Item