Let’s face it, the service ordering process today can be unnecessarily time-consuming and complex with the manual steps, number of partners and credential management process involved. In pursuit of our mission to automate everything automatable in the residential mortgage industry, ICE Mortgage Technology is constantly looking for new, innovative ways to automate traditionally manual tasks and help our customers save time across the loan origination process. That’s why we’re thrilled to introduce a new way for lenders to order services from third party mortgage service providers within our partner network.

Introducing automated service ordering for automated underwriting systems (AUS) and flood determination services.

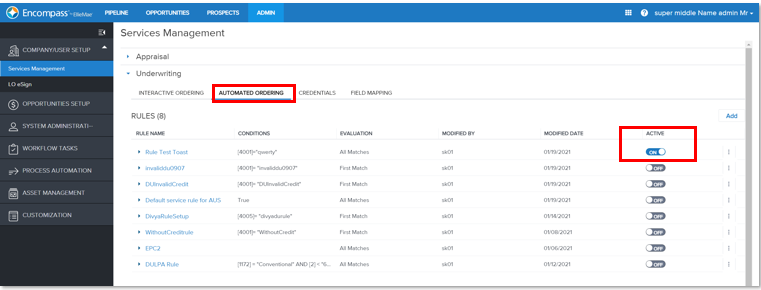

In December 2020, we were excited to introduce automated service ordering for Freddie Mac Loan AdvisorSM tools Loan Product Advisor® and Loan Quality Advisor®, Fannie Mae solutions Desktop Underwriter® and EarlyCheck™, in addition to Flood Zone Determinations by DataVerify™. With the introduction of these new capabilities, lenders can now easily pre-configure AUS and flood zone determination services to be ordered either automatically or in a single click based on loan actions or events that occur in Encompass LO Connect™ or Encompass®. When the services are automatically ordered from these partners, data is then sent back into our system through APIs and populated in relevant document folders and fields across LO Connect and Encompass.

With the update, we’ve also introduced a new intuitively designed user interface within LO Connect for creating and managing service ordering rules (which we call “conditions”) and service ordering permission. For example, through the enhanced interface, you could hypothetically build a rule to automatically order an AUS report every time a credit report is pulled or when a loan reaches a status of “clear-to-close.” The automation rule will then trigger, and the system will be ordered, regardless of whether credit was ordered in LO Connect or Encompass. Through this same process, you can also create a rule to automatically order a flood zone determination report when the "subject property address " has been verified. We’ve heard a lot of excitement from our customers about the introduction of automated service ordering as it represents another tool in their toolkit to save their originators and processors time and increase productivity.

In our February 13th 21.1 Major Release, we’ve made another major enhancement to our service automation experience by introducing the ability to automatically order AUS reports from both Freddie Mac and Fannie Mae at the same time. Following the release, users will now be able to establish rules to submit to one or both AUS engines individually or simultaneously (commonly referred to as “Dual AUS”). These rules can be easily created to trigger automated submissions to one or both GSEs based on events or actions that occur within a loan (i.e. when a loan achieves a “clear-to-close” status). Once an AUS automation rule is triggered, our platform will seamlessly submit relevant loan data to one or both GSE underwriting systems without requiring the lender to take any additional manual actions, assuming all required data is present.

So, why does this matter to you as a lender? A key benefit of ordering AUS reports from multiple GSEs at the same time is that it enables lenders to understand overall eligibility from each GSE early in the lending process – including purchase eligibility, appraisal offers, as well as warranty eligibility for income, employment, and asset verifications. With the eligibility information in hand, lenders can then decide which GSE is the best fit and underwrite that loan to satisfy the appropriate conditions - saving time and money in the process. Using our new automated service ordering capabilities, lenders can also re-submit loan data to both AUS engines to confirm final eligibility with each GSE. Taking this additional step can help inform their post-close strategy and improve salability. It’s also worth noting that Freddie Mac has specifically advocated for the use of Dual AUS ordering as an opportunity for lenders to save time and money in the origination process. It is now a requirement that there be either a Loan Product Advisor or Loan Quality Advisor submission for any loan they purchase.

For these reasons, we’re thrilled to now offer flexible support for Dual AUS ordering as part of our overall automated service ordering solution. Dual AUS ordering, when used in conjunction with the service ordering automation capabilities released in December 2020, is an excellent way for lenders to drive efficiencies that can further reduce origination costs, close loans faster and deliver a better borrower experience.

While our automated service ordering enhancements for AUS and flood reports are exciting steps forward towards our vision of automating everything automatable, we recognize that lenders are eager to automate orders for other types of service providers as well. Ultimately, our goal is to provide lenders with the ability to configure services to be automatically ordered from any relevant service provider in our partner ecosystem. With that said, we’re working closely with the remainder of our service partners in the Marketplace by ICE Mortgage Technology® to make them eligible for automated service ordering, so you can enjoy the same time-savings benefits for all the types of services you order as part of your origination workflow. Stay tuned for more announcements over the course of 2021 for additional service categories that are supported, including appraisal, closing fees, mortgage insurance and credit.

Tips for getting started:

If you’re a current ICE Mortgage Technology customer, we encourage you to leverage these helpful resources to learn more about our new innovative capabilities for driving workflow automation:

- Review the 21.1 Major release notes

- Review our helpful materials on the Encompass LO Connect Customer Resource Center, including“how to get started” videos

- Watch our on-demand Q4 2020 National Sys Admin Call webinar recording which includes an in-depth product demonstration on automated service ordering

- Attend Experience 2021, between March 8-26, to participate in several ASO-focused sessions (There’s no cost to register!)